Pre-Accounting Software Explained for Bookkeepers & SMBs

Discover what pre-accounting software is, how it supports bookkeepers, and why tools like DocGenie make workflows faster, easier, and more accurate.

Introduction: Why Pre-Accounting Is Gaining Attention

Jessica, a seasoned bookkeeper, spends the first hour of her workday chasing down bank statements and utility bills from a half-dozen clients. Each month, it’s the same cycle: follow-up emails, reminders, missing files, and last-minute uploads. It’s not that her clients are disorganized; they’re just busy. But all of this back-and-forth eats into billable time, delays reconciliations, and causes frustration on both sides.

This is where pre-accounting software enters the picture.

In today’s fast-paced business environment, manual document collection is one of the most common workflow bottlenecks. It slows down monthly close processes, increases the risk of errors, and places unnecessary strain on both bookkeepers and small business owners.

Pre-accounting software solves this problem by automating the retrieval, organization, and storage of financial documents before they ever reach an accounting system. These tools are designed to clean up the chaotic paper trail that exists between the client and the books. And for professionals looking to improve efficiency, accuracy, and client experience, pre-accounting automation has quickly gone from a “nice-to-have” to a competitive necessity.

In this guide, we’ll walk through what pre-accounting software actually is, how it fits into your workflow, and why automation tools like DocGenie are helping bookkeepers and small businesses reclaim their time, reduce errors, and work smarter.

What Is Pre-Accounting?

Pre-accounting is the often-overlooked phase in financial workflows where the groundwork is laid for accurate, timely bookkeeping. It involves gathering, organizing, and preparing financial documents such as bank statements, receipts, invoices, and utility bills before they are entered into any accounting system.

In simple terms, pre-accounting is everything that happens before transactions make it into your general ledger. For bookkeepers and small business owners, this means locating files, naming them properly, ensuring nothing is missing, and making sure the documents are ready for reconciliation.

Unlike accounting, which deals with categorizing and analyzing financial data, pre-accounting focuses on the collection and organization of that data at the source. It answers the question: “Do we have the right documents in the right place, at the right time?”

When done manually, pre-accounting can be tedious and error-prone. It often involves dozens of emails, follow-ups, and document uploads across multiple platforms. But with the right tools in place, this process can be simplified and automated, allowing professionals to shift their time toward higher-value work.

Where Pre-Accounting Fits in the Financial Workflow

Pre-accounting fills the space between the client’s day-to-day operations and the moment a transaction is entered into accounting software. It is the bridge that transforms scattered documents into clean, usable records.

For most small businesses and bookkeepers, this step begins when a client receives a bill, pays an invoice, or gets a bank statement. Before that information can be recorded, someone needs to locate the document, confirm it’s accurate and complete, and ensure it’s stored in the right place. That process is the foundation of pre-accounting.

Think of pre-accounting as the first mile in your financial workflow. It prepares raw financial documents for categorization, reconciliation, and reporting. Without it, even the most advanced accounting system is working with incomplete or inconsistent data.

In a typical monthly cycle, pre-accounting happens:

- After the client receives or generates a document

- Before the bookkeeper reconciles accounts or closes the books

It supports better financial hygiene by reducing missing files, delays, and client follow-up. When automated, this step becomes nearly invisible, freeing up time for more strategic work.

What Pre-Accounting Software Does (And Doesn’t Do)

Pre-accounting software includes a wide range of tools that help financial professionals manage documents and data before it enters the books. These solutions are designed to streamline the manual, repetitive tasks that often slow down bookkeeping workflows.

Some tools offer basic document retrieval and storage. Others go further, extracting data, connecting directly to accounting platforms, and helping organize transactions for categorization.

✅ Common Capabilities of Pre-Accounting Software:

- Document retrieval from banks, credit cards, utilities, and service providers

- Cloud-based storage and organization for easy access

- Data extraction using OCR technology (for example, capturing amounts, dates, or vendors from scanned receipts or PDFs)

- Integration with accounting software such as QuickBooks, Xero, or Zoho Books

- Real-time collaboration or messaging features in some platforms

❌ What Pre-Accounting Software Typically Doesn’t Do:

- It does not replace accounting software; it supports it

- It does not make financial decisions or perform analysis on behalf of the bookkeeper

- It may not fit every workflow, especially for firms that only need specific functions like secure document delivery

🔎 Where DocGenie Fits:

DocGenie is a specialized pre-accounting tool focused exclusively on document collection and cloud storage. It does not extract data or integrate with accounting software. Instead, it:

- Automates the retrieval of documents from over 4,000 institutions

- Stores files securely in the client’s preferred cloud storage platform

- Reduces the need to chase clients for missing files

- Improves document consistency and timeliness without altering financial data

For businesses and bookkeepers who value security, control, and automation and who do not need full OCR or direct software integration, DocGenie offers a focused and efficient solution.

Pre-Accounting vs. Accounting Software

Pre-accounting software and accounting software serve different roles in the financial workflow, but both are essential for accurate and efficient bookkeeping. Understanding how they complement one another helps clarify where tools like DocGenie fit into the bigger picture.

🔄 Pre-Accounting Software: Setting the Stage

Pre-accounting tools focus on preparing financial documents before they reach the ledger. Their primary job is to:

- Retrieve and organize documents such as bank statements, utility bills, and receipts

- Ensure those documents are complete, correctly formatted, and stored securely

- Reduce the time spent chasing clients or sorting through scattered files

These tools are typically used by bookkeepers, accountants, and business owners to reduce bottlenecks in the early stages of the monthly or quarterly close process.

🧮 Accounting Software: Recording and Reporting

Accounting platforms like QuickBooks, Xero, and Wave are built for:

- Categorizing transactions

- Reconciling accounts

- Generating reports, invoices, and financial statements

- Managing payroll, taxes, and compliance

They rely on the accuracy and availability of supporting documents to function properly. If key records are missing or arrive late, even the best accounting tools cannot deliver reliable results.

Why the Difference Matters

When pre-accounting is handled efficiently, everything downstream runs more smoothly. Files are available on time, errors are reduced, and bookkeepers can focus on reviewing financials instead of chasing paperwork.

DocGenie plays an important role at this stage. By automating the first step, which is document retrieval, it supports better accuracy, faster workflows, and improved collaboration between clients and bookkeepers.

Why Pre-Accounting Software Matters Today

The demand for pre-accounting software has grown rapidly in recent years. As businesses face tighter deadlines, shifting tax rules, and rising client expectations, financial workflows must become more efficient and less dependent on manual processes. Pre-accounting software addresses this need by removing friction at the very start of the accounting cycle.

One of the biggest pain points for bookkeepers and small business owners is document collection. Waiting on clients to upload bank statements or send utility bills creates delays, introduces errors, and adds stress to monthly close processes. These challenges have only increased in hybrid and remote work environments, where timely communication and file sharing can be inconsistent.

In this context, pre-accounting tools have become more than a convenience. They are now a competitive edge. Firms that adopt automation for document intake are able to:

- Reduce time spent on low-value tasks

- Improve accuracy in financial records

- Serve more clients without increasing overhead

- Strengthen relationships by eliminating repeated follow-ups

At the same time, the market for financial software has grown crowded. Tools like QuickBooks and Xero have streamlined the accounting side, but pre-accounting tools are helping professionals regain control of the front-end. They empower users to clean up inputs before the numbers ever hit a ledger.

Whether you are a solo bookkeeper or part of a growing firm, automation in the pre-accounting stage helps future-proof your workflow. It ensures that your systems are not only faster but also more resilient and scalable. By investing in the right tools now, you are setting the stage for more accurate books and better client experiences every month.

Who Uses Pre-Accounting Software?

Pre-accounting software is used by a wide range of professionals and business owners who want to streamline their financial workflows, reduce manual tasks, and improve document accuracy. Whether working independently or as part of a larger team, these users rely on pre-accounting tools to simplify the document collection process and prepare clean inputs for bookkeeping or accounting.

👩💼 Bookkeepers and Accountants

These professionals are among the most frequent users of pre-accounting tools. For them, the software:

- Eliminates the need to send repeated document requests to clients

- Reduces time spent organizing files before reconciliation

- Ensures that statements, receipts, and invoices arrive on schedule

Many bookkeepers use these tools to serve multiple clients, making document automation an important way to scale without increasing overhead.

🧾 Small Business Owners and Solopreneurs

Business owners often wear many hats, including managing their own books or preparing financials for an external accountant. Pre-accounting tools help by:

- Centralizing financial documents in one secure location

- Making it easier to collaborate with bookkeepers and tax professionals

- Creating a consistent workflow for document handling each month

These tools are especially helpful for busy owners who struggle to keep up with document requests and filing.

📈 Virtual and Cloud-Based Accounting Firms

Firms offering remote or hybrid services often need a scalable, automated system to manage clients across industries. Pre-accounting tools:

- Support a paperless, modern practice

- Integrate with firm workflows and communication platforms

- Help meet deadlines more consistently by automating the front-end of document collection

DocGenie is designed with all of these users in mind. It offers a secure, low-friction solution for retrieving documents from over 4,000 institutions and delivering them directly to the cloud platform of choice.

DocGenie’s Role in the Pre-Accounting Ecosystem

Within the broad category of pre-accounting software, DocGenie occupies a distinct and focused position. While many tools aim to be all-in-one solutions that combine document collection, data extraction, and accounting integration, DocGenie excels by doing one thing exceptionally well — automating the secure retrieval and delivery of financial and service documents.

Rather than competing with platforms like AutoEntry, Dext, or Hubdoc, DocGenie complements them by offering a lean and reliable solution for firms and businesses that want to streamline their document intake without granting third-party apps access to sensitive financial platforms.

🔐 What Makes DocGenie Different:

- Secure, read-only connections to more than 4,000 banks, utilities, and service providers

- OAuth-based authentication that protects client credentials and reduces risk

- No accounting platform integration required, making it ideal for businesses that use multiple systems or manage their own financial records

- Storage in the user’s preferred cloud service, such as Dropbox, Google Drive, OneDrive, Box, or Evernote

- Consistent, reliable delivery of key documents like bank statements, invoices, and utility bills

By focusing solely on secure document collection, DocGenie simplifies the first step in the financial process. This allows bookkeepers and business owners to build their own tech stacks around it, adding the tools they need for data processing, accounting, and reporting, without overlapping features or unnecessary complexity.

In the pre-accounting ecosystem, DocGenie stands out as the trusted solution for those who want control, flexibility, and automation without compromise.

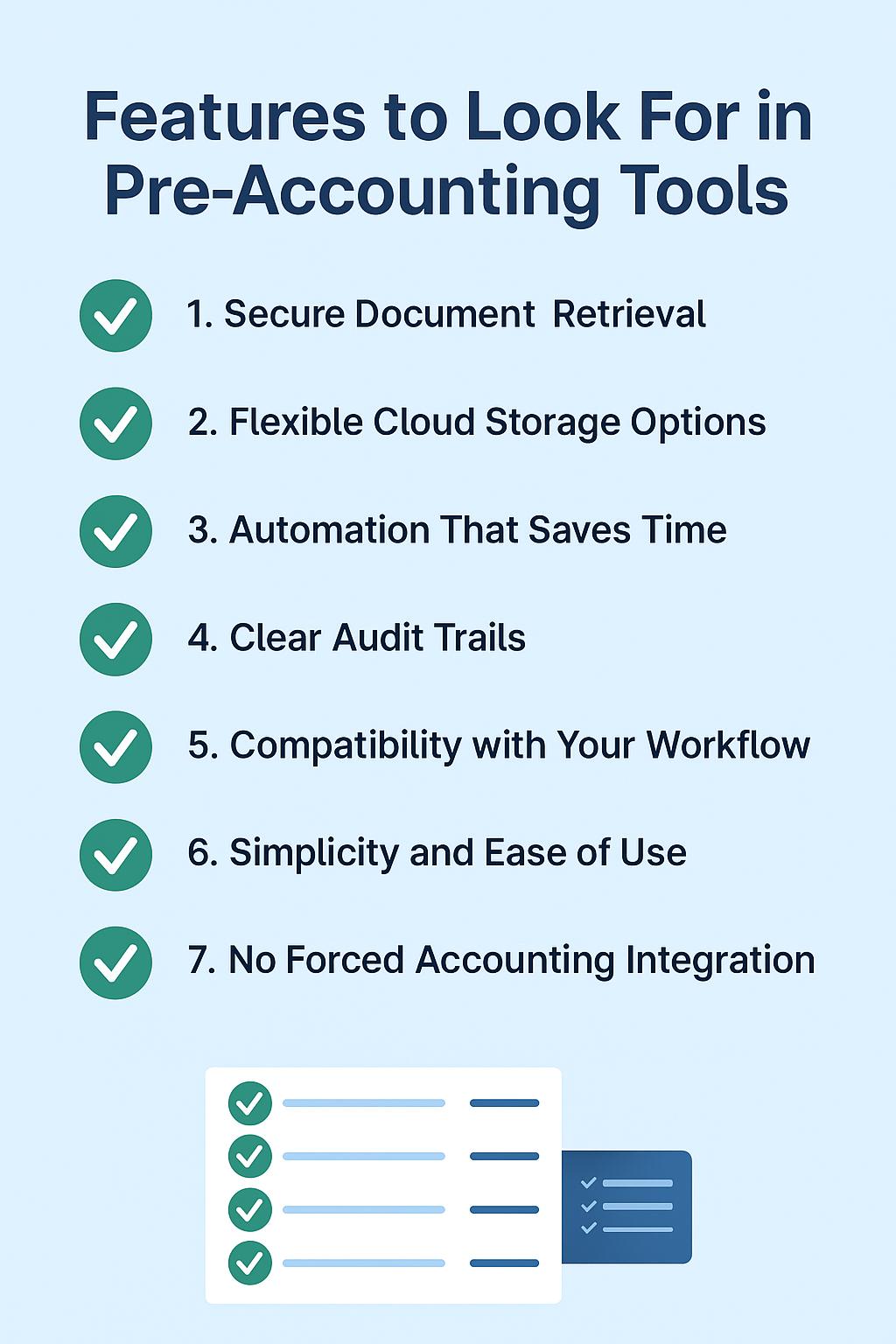

Features to Look For in Pre-Accounting Tools

Choosing the right pre-accounting tool depends on the specific needs of your business or bookkeeping practice. Some tools focus on automation and speed, while others offer data extraction, collaboration, or direct accounting software integration. Understanding what features matter most will help you select the best solution for your workflow.

Here are the key features to evaluate when considering a pre-accounting solution:

✅ 1. Secure Document Retrieval

The most fundamental function of any pre-accounting tool is reliable and secure access to documents. Look for tools that connect directly to banks, utilities, and service providers using secure authentication protocols like OAuth.

✅ 2. Flexible Cloud Storage Options

Some platforms store your data in their own environment, which can limit control or access. A strong pre-accounting tool should allow users to store documents in their preferred cloud platform such as Dropbox, Google Drive, OneDrive, or Box.

✅ 3. Automation That Saves Time

The goal of pre-accounting is to reduce manual work. Tools should offer automatic fetching and organizing of recurring documents like bank statements, receipts, or bills, so users don’t have to chase files every month.

✅ 4. Clear Audit Trails

Being able to track when a document was retrieved and where it was stored helps with compliance and transparency. This is especially helpful during audits or end-of-year reviews.

✅ 5. Compatibility with Your Workflow

Pre-accounting software should fit into your existing processes. Whether you use spreadsheets, practice management software, or bookkeeping platforms like QuickBooks or Xero, the pre-accounting tool should complement—not complicate—your workflow.

✅ 6. Simplicity and Ease of Use

Adoption depends on ease. Choose a solution that is intuitive for your team and your clients. Fewer steps, fewer logins, and clear setup processes reduce friction and improve efficiency.

✅ 7. No Forced Accounting Integration

For users who want to maintain control over how and when data enters accounting platforms, look for pre-accounting tools that allow document retrieval without automatic syncing to bookkeeping software.

Use Cases: When and Why DocGenie Is the Right Fit

Not every business needs a full-featured accounting automation platform. Many simply need a better way to collect financial documents without delays, confusion, or manual follow-ups. This is where DocGenie provides significant value.

DocGenie is the right fit when the priority is secure, automated document collection that fits into your existing workflow. Whether you're a solo bookkeeper, a small business owner, or part of a growing virtual firm, DocGenie helps eliminate the bottlenecks that come with chasing down files.

✅ Common Scenarios Where DocGenie Shines:

1. Client Onboarding Made Easier

Bookkeepers onboarding new clients can immediately connect DocGenie to retrieve historical bank statements, utility bills, and loan documents. This speeds up setup and ensures nothing is missed during intake.

2. Monthly Reconciliation Prep

Instead of waiting for clients to send PDFs or screen captures, documents arrive automatically and are stored in your chosen cloud folder. This saves hours every month and makes reconciliation more accurate and timely.

3. End-of-Year Document Collection

During tax season or year-end cleanup, teams often scramble to gather a backlog of missing files. DocGenie retrieves full histories from financial institutions, helping firms catch up without adding hours of manual effort.

4. Supporting Audit or Compliance Requirements

For businesses or industries where documentation must be retained for regulatory purposes, DocGenie ensures consistent, timestamped delivery of important records.

5. Reducing Client Follow-Up and Friction

If your clients are busy and tend to forget to upload documents, DocGenie removes that responsibility from their plates. Fewer reminders and better compliance keep relationships strong and work flowing smoothly.

How DocGenie Compares to Other Tools in the Space

In the growing category of pre-accounting tools, DocGenie is often compared to platforms like Hubdoc, LedgerDocs, Dext, and AutoEntry. While these tools all aim to streamline financial workflows, their features and focus areas vary significantly.

Understanding how DocGenie compares can help bookkeepers and business owners decide which solution best fits their needs.

🟢 Where DocGenie Stands Out:

- Specialized focus on document retrieval only. No data manipulation or accounting sync

- 4,000+ institution connections using secure OAuth authentication

- Client ownership of files with delivery to the user’s own cloud (Dropbox, Google Drive, OneDrive, Box, or Evernote)

- Ideal for users who want reliable document delivery without linking to accounting software

DocGenie is not trying to be everything at once. It is built for those who want to simplify the first step of financial workflows and retain control over where documents are stored. For firms that already use accounting tools or OCR platforms, DocGenie complements their existing setup without overlap.

Getting Started with Pre-Accounting Automation

Adopting pre-accounting software is one of the simplest ways to eliminate manual friction and future-proof your bookkeeping workflow. Whether you are a solo bookkeeper, a virtual firm, or a small business owner who is tired of chasing documents, getting started is easier than you might think.

Here are a few key steps to help you evaluate, choose, and implement the right pre-accounting solution.

1. Identify Your Document Bottlenecks

Begin by taking inventory of where your workflow slows down. Are you constantly waiting on clients to upload statements? Do you have missing receipts during tax prep? Are documents scattered across email threads, file-sharing platforms, or text messages? Understanding where things break down will help you focus on the features you actually need.

2. Choose a Tool That Matches Your Workflow

There is no one-size-fits-all solution when it comes to pre-accounting tools. Some businesses may need full OCR and accounting integration. Others simply need faster access to consistent documents each month. Look for software that:

- Retrieves documents from the sources you use most (such as banks, credit cards, and utility providers)

- Delivers them into a cloud folder you already work with

- Fits your security and compliance preferences

For those who want control, automation, and flexibility, DocGenie is an ideal choice.

3. Set Up Secure Connections

Once you have selected your tool, setting up secure connections is the first step. DocGenie uses bank-level security, including read-only access and OAuth-based authentication, to protect user credentials while enabling automated retrieval from over 4,000 institutions.

This process takes just a few minutes per institution and ensures your monthly documents arrive on time, every time.

4. Organize Your Cloud Storage for Success

Create a consistent folder structure in your cloud storage platform (Google Drive, Dropbox, OneDrive, Box, or Evernote). Clear naming conventions and subfolders by month or account type will make future searches and audits easier. DocGenie delivers files directly to your folder of choice, keeping your records in one place. This guide on going paperless shares practical tips and best practices that can strengthen your organization's system.

5. Communicate the Change to Clients

If you work with clients, let them know what to expect. Automated document retrieval reduces their workload, saves them time, and eliminates repetitive email requests. Framing the switch as a benefit to them will help improve adoption and reduce resistance.

You can even include a short guide or a 60-second walkthrough video to show how easy the new process is.

6. Monitor and Refine

As with any new workflow, it is important to track performance. Set a calendar reminder to review your setup after the first 30 days. Are all files arriving as expected? Are there edge cases you need to handle manually? Refine folder naming, tweak permissions, and troubleshoot any gaps to keep things running smoothly.

Final Thoughts and Next Steps

Pre-accounting software is transforming how businesses and bookkeepers manage their financial workflows. By addressing document collection before accounting begins, these tools reduce delays, improve accuracy, and save valuable time. While some platforms focus on data extraction and syncing with accounting software, others specialize in making the intake process more seamless and secure.

DocGenie offers a practical solution for firms and business owners who want to automate document retrieval without connecting to their accounting platforms. Its ability to fetch statements, invoices, and other financial records from over 4,000 institutions and store them securely in the user's own cloud makes it an essential first step in any modern bookkeeping workflow.

If you're tired of chasing down documents, missing files, or piecing together financial records at the last minute, it may be time to rethink your workflow.

✅ Ready to streamline your pre-accounting process? Try DocGenie for free or schedule a demo today.